“Why should I take control of my money, I’m managing just fine”. This may be true, but circumstances can and do change.

Life isn’t all about money but it definitely does help. Thinking about the things we do on a day to day basis –money impacts most of them. Taking control of your current situation is the first step on the journey to better finances.

Step 1 – Ask yourself “What do I want?”

What is it that you want in life – to retire early, a second home in a tropical location, four vacays a year, financial freedom, the list could go on. Unless your surname is Jones forget about the Joneses and trying to keep up with them. This goal is personal to you and unlikely to be the same as the next person’s unless you are seeking the exact same things in life (highly unlikely). There is no one size fits all, so run your own race.

This will be your motivation to keep on going especially when things get tough and you’re tempted with giving up, so make sure that it is clear. I find it useful to have a list or visual that I can look at as a reminder of my goals and the alternative if I don’t take control of things now.

Destination Goals :Maldives – Adaaran Club Rannalhi – OTRS photosubmission. Wikimedia

Having a clear vision of what you want is one of the hardest parts! Once you have that nailed down and understand what you will need financially to realise your goal; the power of planning, focus, commitment and consistent action will help get the ball rolling!

Step 2 – Understand where you are now (i.e. what is your current financial situation)

Now this is the bit where you need to be honest with yourself if progress is to be made. Whether good or bad the key thing is that you know what your starting point is. This will help put a plan in place and highlight priority areas (e.g. paying down debt/ establishing an emergency fund/diversifying).

Microsoft Excel is really handy here but if you feel more comfortable with pen, paper and calculator – that works too.

Ask yourself:

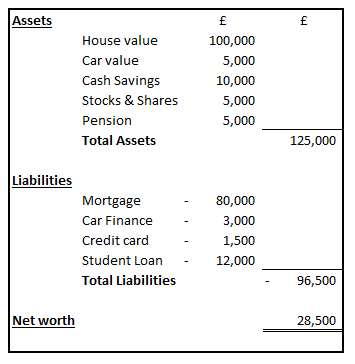

- How much do you have? List your assets – e.g. House, Car, Business, Savings, Stocks & Shares, Pension, etc.

- How much do you owe? List your liabilities – e.g. Mortgage, Car finance, Student loans, Credit cards, other loans.

Once you have this list you can then work out your current position or net worth (check out the example below).

Now if like me the first time you did this the result was negative, do not panic!!! This is likely to be the case if you are young, have relatively few assets and outstanding debt. You are one step ahead of most in terms of taking control of your financial future. In short, you know what you’re situation is, so are able to do something about it.

Step 3 – Put a budget in place

If you haven’t already PUT A BUDGET IN PLACE IMMEDIATELY! This will help you plan your monthly spend and avoid making any debt problems worse by spending more than you have coming in.

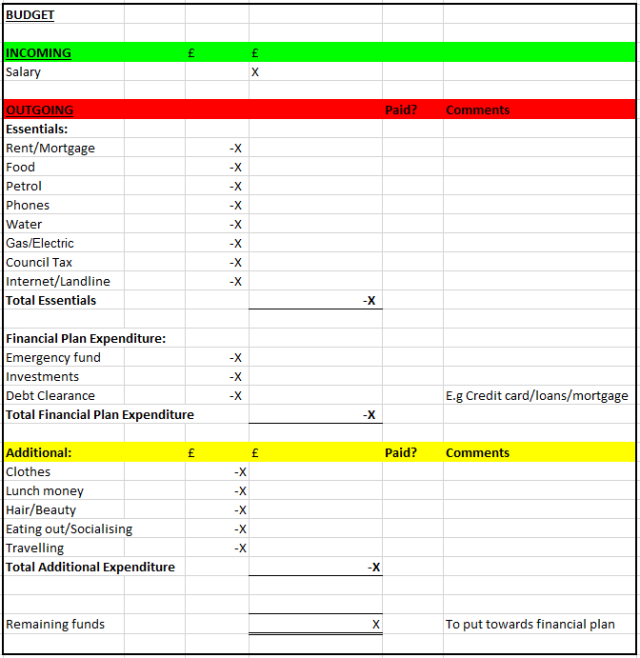

Here I have used my trusty friend Excel to set up an illustrative budget – I like to split it between essential expenses, savings that will help achieve my financial goals and additional expenditure. You may choose to categorise some items differently or have other essential expenditure (e.g. Car repayments, insurance, etc).

The key here is to be realistic. Deciding that you’re going to live on £1 a day and suddenly save 80% of your income is not going to work! In my first budget I’d decided to not factor in anything for nights out/socialising – needless to say I kept dipping into my savings and putting the “odd” thing on my card. You don’t need to be extreme as you won’t stick to such a budget and you’ll get ridiculously frustrated in the process. Also you can scale back on any additional expenditure if you are hit with any unexpected costs.

To understand what you spend your money on have a look at previous months’ bank statements as a guide (online banking is very useful here). I remember the shock when I first did this and discovered I’d spent £80 on lunch that month and £40 on my “occasional” hot chocolate. That’s £120 that could have been put to better use.

Once you’re budget is in place, STICK TO IT! Automate payments to savings/credit cards/etc where possible as willpower doesn’t always win in the “should I buy these new shoes/go for drinks or pay off the credit card” debate.

For more steps see- Taking control of your money: Part 2.